Betting Big: 3 AI Stocks Primed for a Breakout

How to Get Rich With AI Stocks Before They Become the Next FAANG

Artificial intelligence (AI) is transforming industries and economies around the world. From healthcare to finance, manufacturing, and beyond, AI is enabling breakthrough capabilities and unprecedented efficiencies. As adoption continues to accelerate, the companies developing and delivering cutting-edge AI solutions stand to capture tremendous value.

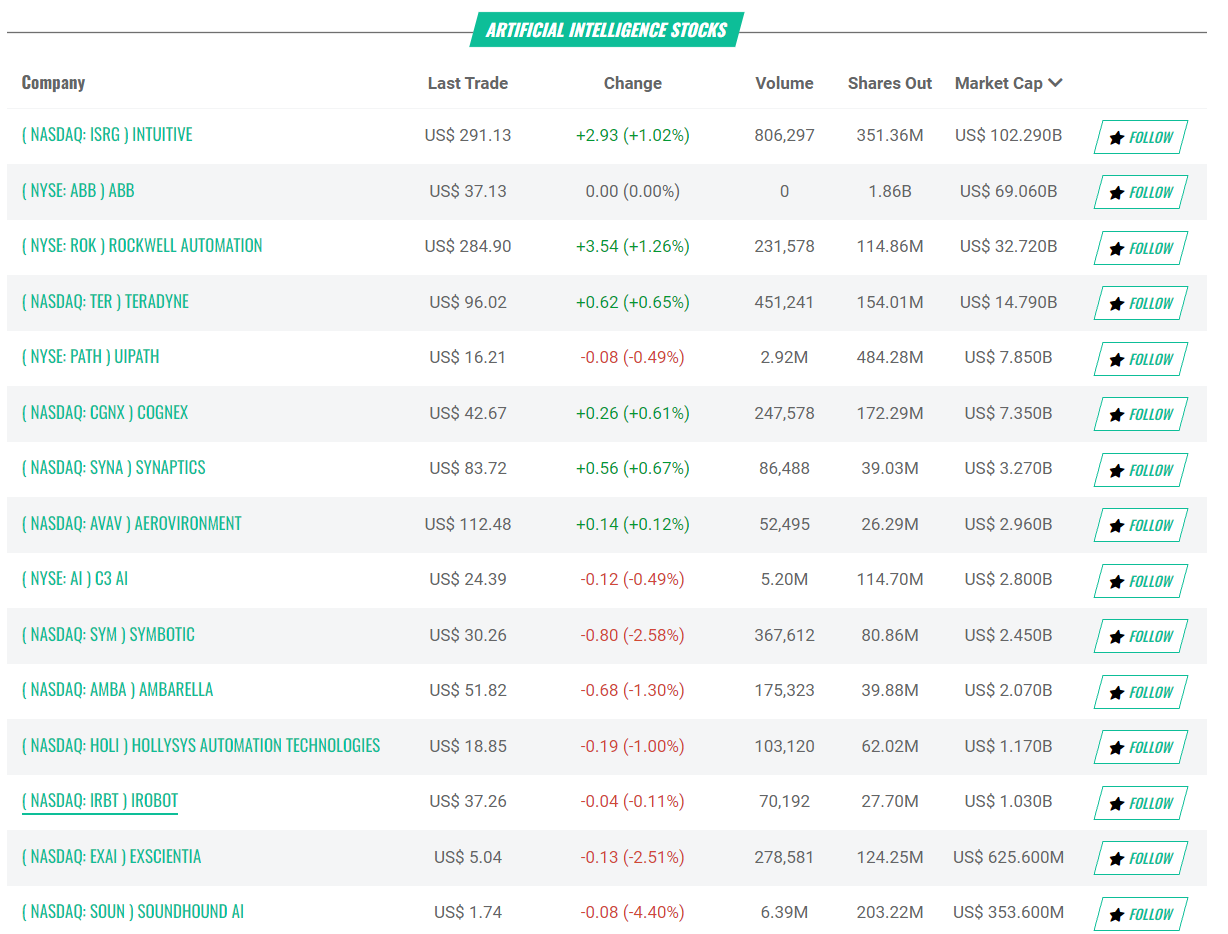

According to one estimate, the total economic impact of AI could reach $15.7 trillion globally by 2030. With this massive growth potential, investors are seeking out the top AI stocks that can deliver market-beating returns. In particular, there are a few key players that look primed for a major breakout in the years ahead.

C3.ai: Growth Accelerating After Deep Correction

C3.ai (NYSE: AI) provides enterprise AI software for accelerating digital transformation. The company offers a comprehensive suite of fully integrated services including application development, machine learning, and AI modeling. Leading organizations across a wide range of industries leverage C3.ai to rapidly build, deploy, and scale AI-enabled applications.

The company has established an impressive blue-chip customer base with industry leaders like Baker Hughes, Koch Industries, and the United States Air Force. C3.ai continues to expand its ecosystem with major partnerships such as Microsoft Azure, AWS, and Google Cloud.

C3.ai stock surged in late 2020 and early 2021on the heels of its IPO debut. Shares hit an all-time high above $170 before sliding over the past year. This deep correction provides an attractive entry point for long-term investors. The stock now trades around $25 with analysts projecting 25% upside potential over the next 12 months.

Importantly, C3.ai’s growth trajectory remains strong. In the most recent quarter, subscription revenue expanded 38% and gross profit margin improved to 76%. The company expects full-year revenue growth of 29% at the midpoint of guidance. It closed 12 new generative AI enterprise customers in the first half of 2022 and has a qualified pipeline of over 140 opportunities.

As subscription revenue continues to scale, C3.ai is well positioned to drive margin expansion and cash flow growth. The company ended the latest quarter with a strong balance sheet including $992 million in cash. This provides ample capital to fund growth initiatives in the years ahead.

For investors seeking exposure to enterprise AI software, C3.ai represents an attractive opportunity trading at around 7x sales. The company is executing well, expanding its customer base, and benefiting from growing demand for AI transformation. After pulling back considerably from its highs, AI stock looks poised for a sustained recovery rally.

Nvidia: Massive AI Market Opportunity

Nvidia (NASDAQ: NVDA) is the undisputed leader in AI hardware. The company’s GPUs provide the processing power behind many of the world’s most advanced AI systems. Nvidia has leveraged its technology strengths to establish leading positions across gaming, data centers, autonomous vehicles, robotics, and other high-growth segments.

According to Nvidia executive Manuvir Das, the company estimates the potential AI market opportunity at around $600 billion. Nvidia is laser-focused on capturing as much of this massive prize as possible.

The company recently announced major partnerships to accelerate AI adoption in India. Nvidia will work with India’s leading technology services firm, Tata Group, to establish AI infrastructure across healthcare, retail, finance, and other industries. Additionally, Reliance Jio, India's largest mobile network operator, will incorporate Nvidia AI solutions to enable cloud-based enterprise offerings.

These strategic moves provide Nvidia with access to one of the world’s fastest growing technology markets. India represents a multi-billion dollar revenue opportunity for the company’s AI platform over the next decade. Nvidia is also mitigating geopolitical risks by expanding beyond China where it derives around 25% of total sales.

After peaking near $350 in late 2021, NVDA stock has pulled back to around $410. While still elevated compared to historical valuations, the correction provides an opportunity for long-term investors.

Nvidia dominates some of technology's most critical growth markets including data center accelerators, autonomous vehicles, and the metaverse. The company delivered 34% revenue growth in its most recent quarter along with a 29% operating margin.

With strong execution and exposure to AI, Nvidia appears well positioned to continue generating market-beating returns. Patient investors could be rewarded for buying NVDA stock at current levels.

Upstart: Pioneering AI Lending

Upstart Holdings (NASDAQ: UPST) is a leading artificial intelligence lending platform. The company applies modern AI and machine learning techniques to improve access to affordable credit while reducing risk for lending partners.

Upstart’s platform enables banks and other credit providers to quickly evaluate applicants. By leveraging non-traditional variables beyond credit scores, the AI models can approve borrowers who may have been overlooked or underserved by traditional approaches.

The company has already facilitated over $16 billion in loans with its AI lending technology. Upstart has established partnerships with 31 banks and credit unions to streamline their operations and lower loss rates.

The addressable market opportunity is massive. Around $4 trillion of consumer loans are originated each year just in the United States. Upstart is pioneering the use of artificial intelligence to transform this high-volume, low-margin business.

After surging over 1,000% in 2021, Upstart stock plummeted this year amid the broader sell-off in high-growth names. Shares have plunged around 80% from their peak. However, the dramatic pullback seems disconnected from Upstart’s underlying business performance.

In the most recent quarter, Upstart grew revenue 57% and adjusted EBITDA 49%. The contribution margin expanded to 67% as the company benefits from economies of scale. Importantly, Upstart achieved positive cash flow from operations in the quarter demonstrating improving capital efficiency.

Despite the huge correction, Upstart still trades around 50x forward earnings estimates. The premium valuation leaves little room for disappointment, and the stock could see continued volatility in the near-term.

However, for investors comfortable with higher-growth, higher-risk names, Upstart provides exposure to a pioneering AI business with vast disruptive potential. The company is successfully demonstrating the viability of AI lending technology and stands to benefit immensely as adoption accelerates.

Key Takeaways

Artificial intelligence adoption is still in the very early innings across most industries. As AI transforms business models over the next decade, leading technology platforms enabling this revolution stand to generate tremendous value.

C3.ai, Nvidia, and Upstart each provide targeted exposure to high-growth AI end markets. While these stocks carry higher risk profiles, their upside potential remains substantial supported by multi-billion dollar addressable opportunities.

After pullbacks from frothy valuations, now could be an opportune time to start building positions in these AI innovators. Each name appears primed for a breakout rally amid accelerating digital transformation and rising AI investment.

For investors seeking big returns, the AI stocks profiled above warrant close consideration. By making calculated bets on the pioneers driving AI proliferation, portfolios could capture substantial wealth creation in the years ahead.