The Smarter Way to Pick Stocks: AI-Powered Analysis for Smarter Investing

Hedge Funds Don't Want You to Know About This Disruptive A.I. Investing App

In today's volatile markets, stock picking is harder than ever. With thousands of stocks and ETFs to choose from, how can you reliably identify the best investment opportunities? This is where artificial intelligence comes in.

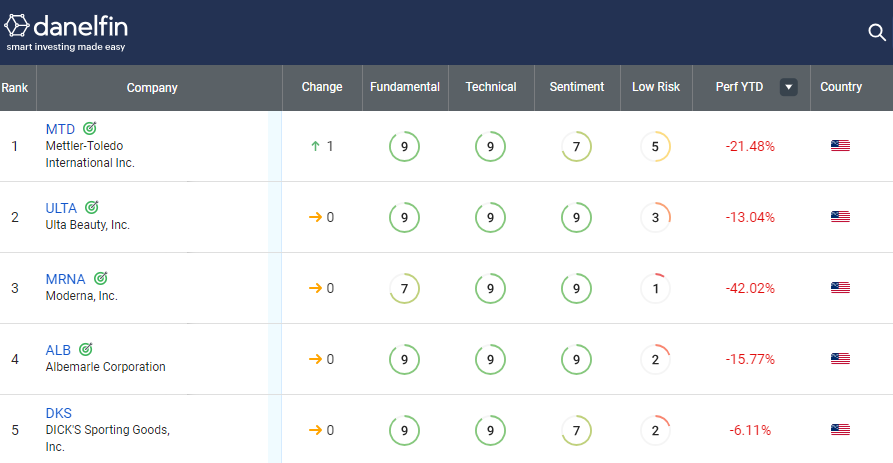

AI-powered tools like Danelfin are revolutionizing stock analysis and selection using advanced machine learning algorithms. Danelfin analyzes vast amounts of data on each stock and ETF - including technical, fundamental and sentiment indicators - to generate an easy-to-understand AI Score indicating its potential to outperform the market.

Unlike opaque black box systems, Danelfin uses explainable AI to show the key factors behind each score. This empowers investors to make smarter data-driven decisions.

The Power of AI Scores

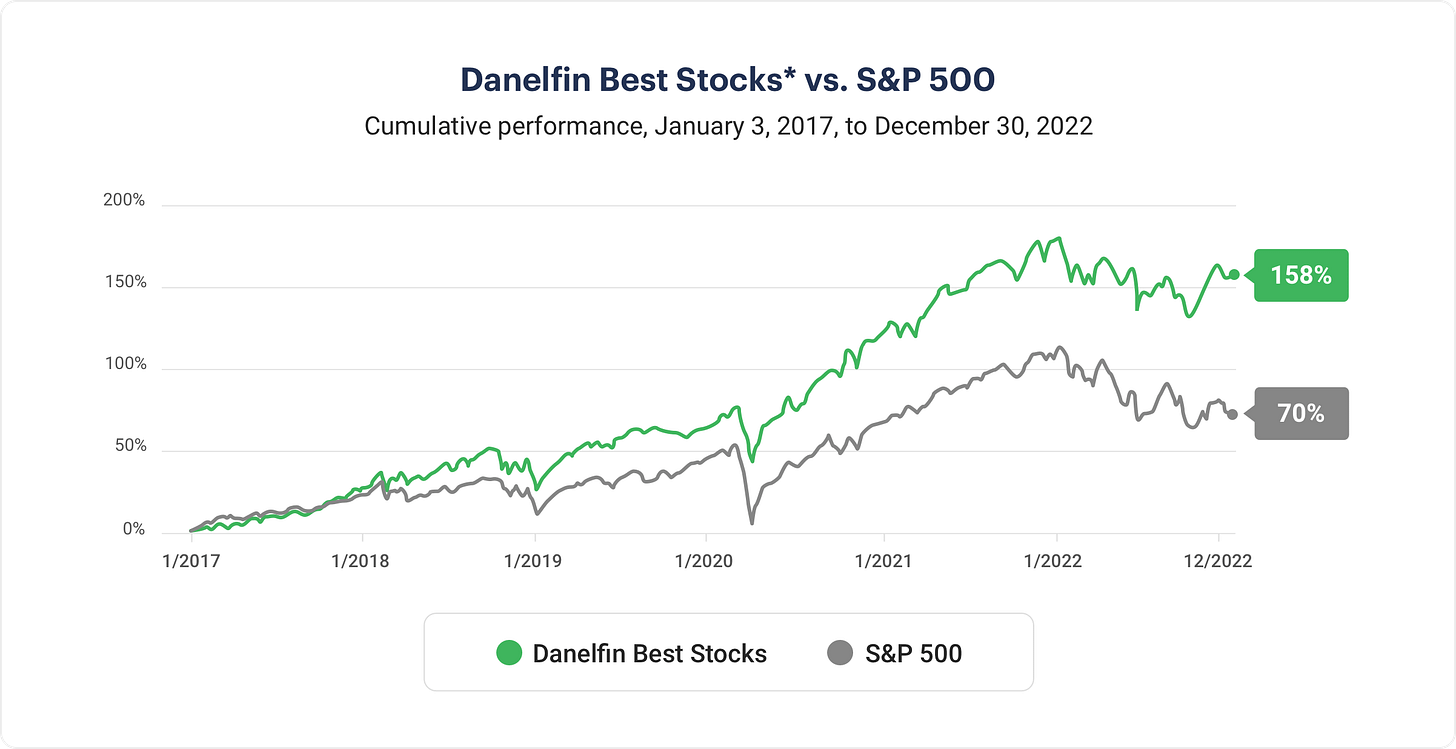

Danelfin's AI Scores range from 1 to 10, with higher scores indicating a higher probability of beating the market over a 3-month horizon. Backtesting shows stocks with the top scores consistently outperform, while low scoring stocks underperform.

Specifically, over the past 5 years, US stocks with the maximum 10/10 AI Score outperformed the S&P 500 by a sizable +20% annualized over 3 months. The lowest scoring stocks lagged the market by -31% annualized.

Similarly, European stocks with top AI Scores outperformed the STOXX 600 by +23% annualized, versus -8% underperformance for the lowest scored stocks.

This demonstrates the predictive power of AI-based scoring. Danelfin leverages machine learning to uncover complex patterns in stock data that even seasoned analysts can miss.

Actionable Investment Ideas

In addition to scores, Danelfin generates specific stock and ETF investment ideas with a proven historical track record.

The Trade Ideas tool surfaces potential long and short trades where the AI has been especially accurate since 2017, with at least 60% directional accuracy. Investors can filter ideas by 1-month, 3-month and 6-month horizons to match their strategy.

Seeing each stock or ETF's historical buy/sell signal performance provides powerful insights. You can clearly evaluate whether to act on a given AI-backed idea.

For example, the AI may have an 80% historical accuracy for 3-month buy signals on a particular stock. This gives you greater conviction for going long. On the flip side, it may have a 70% accuracy for sell signals, cautioning against opening a long position.

Build Smarter Stock Portfolios

Active investors can use Danelfin to optimize their overall portfolio's AI Score. The goal is to tilt your portfolio towards stocks scoring 7+ to capitalize on their higher upside potential.

You can get daily alerts on score changes to watch for any holdings that drop into risky territory. This allows you to take timely corrective actions, whether trimming or closing positions.

Continuously monitoring your portfolio's average AI Score helps ensure you maintain an intelligent overall exposure level.

Danelfin also enables you to easily track score changes over time for stocks on your watchlist. This empowers you to pinpoint ideal moments to invest in a stock when the AI Score moves into a favorable zone.

Patiently waiting for "buy" signals on your wishlist stocks based on Score upgrades can lead to better timing and returns.

Choose an AI-Powered Investment Style

Danelfin understands different investors have different styles. Some prefer technical signals, while others favor fundamentals or sentiment indicators.

That's why Danelfin provides specialized Fundamental, Technical and Sentiment subscores in addition to the overall AI Score.

For example, a value investor may overweight stocks with the highest Fundamental subscores. A chartist can filter on Technical subscores instead.

You can combine these subscores with the top AI Score stocks in creative ways to match your philosophy. The Low Risk subscore also allows limiting volatility.

Continuously Evolving AI Models

The key to successful AI is models that continuously learn and improve. Danelfin retrains its machine learning algorithms daily using the latest data. This allows it to adapt to changing market conditions.

The system identifies the features with the strongest predictive power based on recent results. It then focuses the models on these high value "alpha signals" to maximize accuracy.

This relentless iteration enables Danelfin's AI Scores to keep getting smarter over time. As the AI processes more data, it gets better at modeling risks and opportunities in the market.

Transparent AI for Smarter Investing

Danelfin departs from the opaque black box AI often used in finance. It instead employs transparent models you can understand.

The system highlights the top positive and negative alpha signals driving each stock's scores. This explainable AI approach builds trust by letting you see how the AI is analyzing stocks.

Understanding the key factors behind the scores allows you to incorporate your own human insight into decision making. This combines the power of AI with your expertise for the smartest results.

The Bottom Line

AI-powered analytics offer a big edge in today's data-fueled markets. Tools like Danelfin level the playing field for individual investors by democratizing institutional-grade analytics.

Leveraging AI signals, scores, ideas and portfolio monitoring enables smarter data-driven investing. The result is better-informed investment decisions and potentially improved returns.

In a complex investing world, AI gives you an intelligent guide. By partnering human insight with robust AI, any investor can make more profitable investment choices.